MiCA's Impact on VASP Fund Segregation in UTXO Blockchains: Best Practices Explained

- ASD Labs

- Feb 5, 2025

- 4 min read

Updated: Nov 19, 2025

The European Union’s Markets in Crypto Assets Regulation (MiCA) is set to reshape the operational and compliance landscape for Virtual Asset Service Providers (VASPs). Among its many provisions, MiCA places a strong emphasis on custodial standards and the segregation of client funds, ensuring that user assets remain legally and operationally distinct from a VASP’s own holdings.

For instance, under Article 70 (Safekeeping of clients’ crypto-assets and funds), MiCA explicitly states:

“Crypto-asset service providers that hold crypto-assets belonging to clients or the means of access to such crypto-assets shall make adequate arrangements to safeguard the ownership rights of clients, especially in the event of the crypto-asset service provider’s insolvency, and to prevent the use of clients’ crypto-assets for their own account.”(Article 70(1))

Such clarity underscores the EU’s commitment to consumer protection and the push for greater operational transparency among VASPs. The core principle is clear: VASPs operating in the EU must establish and demonstrate a robust governance framework to segregate and protect client assets.

Why VASP Fund Segregation Matters Under MiCA

🔒 Regulatory Compliance & Governance

MiCA holds VASPs accountable for the proper management of client funds. By implementing clear segregation practices, firms can minimize regulatory risk and position themselves as trusted, compliant providers.

🔒 Risk Mitigation

Keeping client assets separate from operational reserves ensures that unforeseen events (e.g., insolvency, lawsuits, operational failures) do not endanger user holdings.

🔒 Customer Protection & Trust

Clear segregation practices enhance transparency, ensuring clients can verify their assets are distinct, secure, and traceable at all times.

Two Layers of Fund Segregation

A comprehensive fund segregation model operates on two levels:

🌐 On-Chain (Physical) Segregation

In a UTXO-based blockchain like Bitcoin, each Unspent Transaction Output (UTXO) is unique. This structure allows VASPs to manage separate wallet addresses (or “cohorts”) for different categories of funds, such as:

Client Deposits

Treasury Reserves

Quarantined (Bad Funds) Accounts

🌐 Company-Level (Database) Segregation

On-chain separation is only half the equation. VASPs must maintain an internal ledger that accurately tracks ownership of each client’s share within pooled wallets. This ensures real-time reconciliation and audit readiness.

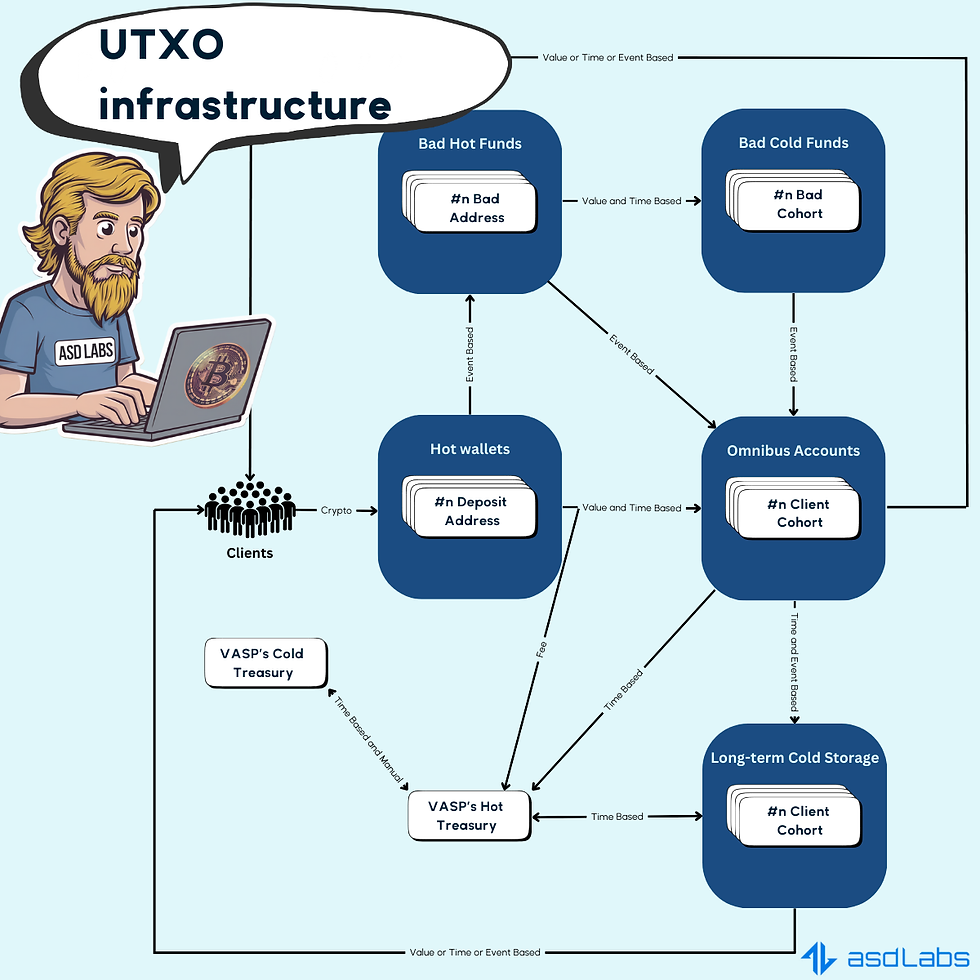

High-Level Diagram: A Generalized UTXO Infrastructure

Below is a best-practice flow for managing client funds while maintaining regulatory compliance.

🛠️ Client Deposits & Hot Wallets

Each client deposit address (UTXO) feeds into hot wallets for quick liquidity.

Sweeps occur at set intervals or when specific thresholds are met.

🛠️ Omnibus Accounts (Client Cohorts)

Funds move into omnibus accounts, with on-chain subdivisions by risk tier or account type.

This provides partial segregation while maintaining efficiency.

🛠️ Treasury (Hot & Cold)

Hot Treasury: Stores operational funds, including fees.

Cold Treasury: Holds long-term reserves with stricter access controls.

Treasury wallets must be distinct from client omnibus wallets to meet MiCA's anti-commingling requirements.

🛠️ Long-Term Cold Storage

Large or infrequently accessed client deposits are transferred to deep cold storage.

This significantly reduces the risk of online threats.

🛠️ "Bad Funds" / Quarantine Addresses

Flagged transactions (e.g., potential sanctions violations, AML concerns) are routed to an isolated quarantine address.

Example: If a deposit is linked to a sanctioned entity, it is segregated immediately and moved to offline storage if further investigation is needed.

Flow Chart for UTXO blockchain infrastructure

Practical Implementation Strategies

📈 Daily Blockchain Reconciliation

Best Practice: Conduct full blockchain reconciliations daily to ensure on-chain balances match internal records.

📈 Managing "Bad Funds"

3-Day Rule: If an investigation exceeds three days, move the assets from the hot quarantine wallet to cold storage to reduce risk exposure.

📈 Hot Wallet Risk Management

Limit exposure by treating the hot wallet balance as the maximum allowable risk.

Regularly transfer excess funds to cold storage.

📈 Multi-Signature Approval Flows

Hot Wallet Moves: Use a 2-of-3 signature scheme (Operations + Automated Signing Service).

Cold Storage Withdrawals: Require executive-level approval via offline keys.

📈 Address Whitelisting

Restrict wallet movements to pre-approved addresses.

Prevent accidental or unauthorized transfers.

📈 Event-Driven Value Movements

Define clear triggers for transfers (e.g., AML flags, liquidity needs, security events).

A Brief Note on Proof of Reserves (PoR)

To strengthen client confidence, Proof of Reserves (PoR) demonstrates that on-chain balances match liabilities recorded in internal databases. MiCA may increase pressure on VASPs to adopt auditable PoR methodologies, such as:

Merkle-tree proofs

Cryptographic attestations

UTXO vs. Account-Based Blockchains

UTXO Model (e.g., Bitcoin)

Distinct transaction outputs allow for clear segregation.

Enables direct allocation of funds to specific purposes (e.g., client funds, operational reserves, bad funds).

Account-Based Model (e.g., Ethereum)

Requires smart contracts or internal sub-accounts to enforce segregation.

Segregation relies more on database-level tracking than physical on-chain separation.

Regardless of the model, VASP fund segregation remains critical to ensuring compliance, security, and trust.

The Road Ahead

With MiCA redefining governance standards, VASPs must implement structured, audit-ready VASP fund segregation models. Those that proactively adopt best practices will be best positioned for regulatory approval and long-term sustainability.

If you’re looking to build a MiCA-compliant fund segregation model, our team can help you design a solution tailored to your business model, blockchain infrastructure, and regulatory obligations.

Let's build a transparent, compliant, and secure digital asset ecosystem together.

For more information on our services, visit our services page.

Disclaimer: This article provides general information and does not constitute legal or financial advice. Always consult legal, compliance, and technical experts for guidance specific to your organization.

Comments